Can I file my amended return electronically? It may take up to 3 weeks for your amended return to show in our system. Additional Informationįor more information, refer to Should I File an Amended Return?, the Instructions for Form 1040-X and "What If I Made a Mistake?" in Chapter 1 of Publication 17, Your Federal Income Tax for Individuals.You can check the status of your amended return with the Where’s My Amended Return tool.

#TURBOTAX 1040X AMENDMENT HOW TO#

For information on how to correct your state tax return, contact your state tax agency. State Tax ReturnsĪ change made on your federal return may affect your state tax liability. Please note: Due to COVID-19 processing delays, it’s taking us more than 20 weeks to process amended returns. Both tools are available in English and Spanish and track the status of amended returns for the current tax year and up to three prior tax years. Amended Return StatusĬheck the Where's My Amended Return? online tool or call the toll-free telephone number 86 three weeks after you file your amended return. For more information, refer to the Instructions for Form 1040-X. Special rules apply for refund claims relating to net operating losses, foreign tax credits, bad debts, and other issues. Returns filed before the due date (without regard to extensions) are considered filed on the due date, and withholding is deemed to be tax paid on the due date. Generally, to claim a refund, you must file Form 1040-X within 3 years after the date you filed your original return or within 2 years after the date you paid the tax, whichever is later. If you file after the due date, don't include any interest or penalties on Form 1040-X they will be adjusted accordingly. If the filing due date falls on a Saturday, Sunday, or legal holiday, your amended return is timely if filed or paid the next business day. If you owe additional tax, and the due date for filing that tax return hasn't passed, you can avoid penalties and interest if you file Form 1040-X and pay the tax by the filing due date for that year (without regard to any extension of time to file). For more details, see February 9, 2023, news release. However, including direct deposit information on an electronically submitted form provides a convenient and secure way to receive your refund faster.

#TURBOTAX 1040X AMENDMENT MANUAL#

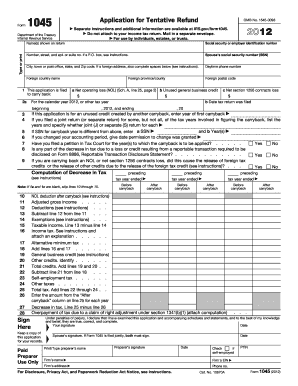

You should follow the instructions for preparing and submitting the paper form.Ĭurrent processing time is more than 20 weeks for both paper and electronically filed amended returns, as amending a return remains a manual process. You still have the option to submit a paper version of Form 1040-X and receive a paper check. If you electronically file your Form 1040-X, Amended U.S Individual Income Tax Return, you can select direct deposit and enter your banking or financial institution information for quicker delivery of your refund. Individual Income Tax Return, to correct a previously filed Form 1040-series return or to change amounts previously adjusted by the IRS. However, file an amended return if there's a change in your filing status, income, deductions, credits, or tax liability. In these instances, there's no need to amend your return. The IRS may correct certain errors on a return and may accept returns without certain required forms or schedules.

If you discover an error after filing your return, you may need to amend your return.

0 kommentar(er)

0 kommentar(er)